What are all the cryptocurrencies

Another example is intra-company money transfers. Digital currencies are an ideal means of transferring money swiftly and without any hassle between subsidiaries and headquarters https://magazroxik.info/rfa-mma/. Stablecoins, as well as commercial bank money tokens, are a good choice for this use case.

By all accounts, PSD2 did reduce payment fraud in the countries of the EEC. But in the wake of PSD2 implementation, some expected ATO attacks to increase as a result. It is difficult to gauge exactly how much this legislation contributed to the rise of ATOs. We can point to other developments, such as customers saving bank card details in their online accounts more often than before, as well as occasional insufficient protection from companies, as also instrumental.

Additionally, reconciliation processes are undergoing a transformation. Aaron Holmes of Kani Payments highlights the inefficiencies of manual reconciliation, with many businesses still relying on spreadsheets. Advanced reconciliation tools are expected to save time, improve accuracy, and enable scalable growth.

Across industries, the best tech offers superior performance, low friction and a great user experience. In payments, reliability and security are essential. That is why we’re seeing new systems gain real traction.

Risk disclosure: Investing in financial instruments, digital assets, and fintech-related products carries significant risk and may result in the loss of your entire investment. These markets are volatile and influenced by regulatory, technological, and political developments. Such investments may not be suitable for all investors. You should carefully consider your financial objectives, experience, and risk appetite before investing. Seek independent advice where appropriate. Fintech Review does not provide investment advice or endorsements. All content, including news, press releases, sponsored material, advertisements or any such content on this website, is for informational purposes only and should not be treated as a recommendation or promotion of any financial product or service. Fintech Review is not affiliated with, and does not verify or endorse, any project, cryptocurrency, token, or any type of service or product featured in promotional or third-party content. Readers must conduct their own due diligence before acting on any information.

Are all cryptocurrencies mined

Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. Whether it’s to pass that big test, qualify for that big promotion or even master that cooking technique; people who rely on dummies, rely on it to learn the critical skills and relevant information necessary for success.

A business structure can be a good idea if your mining operation has multiple owners. You can create a business contract that outlines details like ownership stake and what percentage of profits each owner is entitled to.

Monero is unique in that it prioritizes privacy and anonymity, offering features like ring signatures and stealth addresses. Its CPU-mining-friendly algorithm makes it an attractive option for smaller-scale miners.

Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. Whether it’s to pass that big test, qualify for that big promotion or even master that cooking technique; people who rely on dummies, rely on it to learn the critical skills and relevant information necessary for success.

A business structure can be a good idea if your mining operation has multiple owners. You can create a business contract that outlines details like ownership stake and what percentage of profits each owner is entitled to.

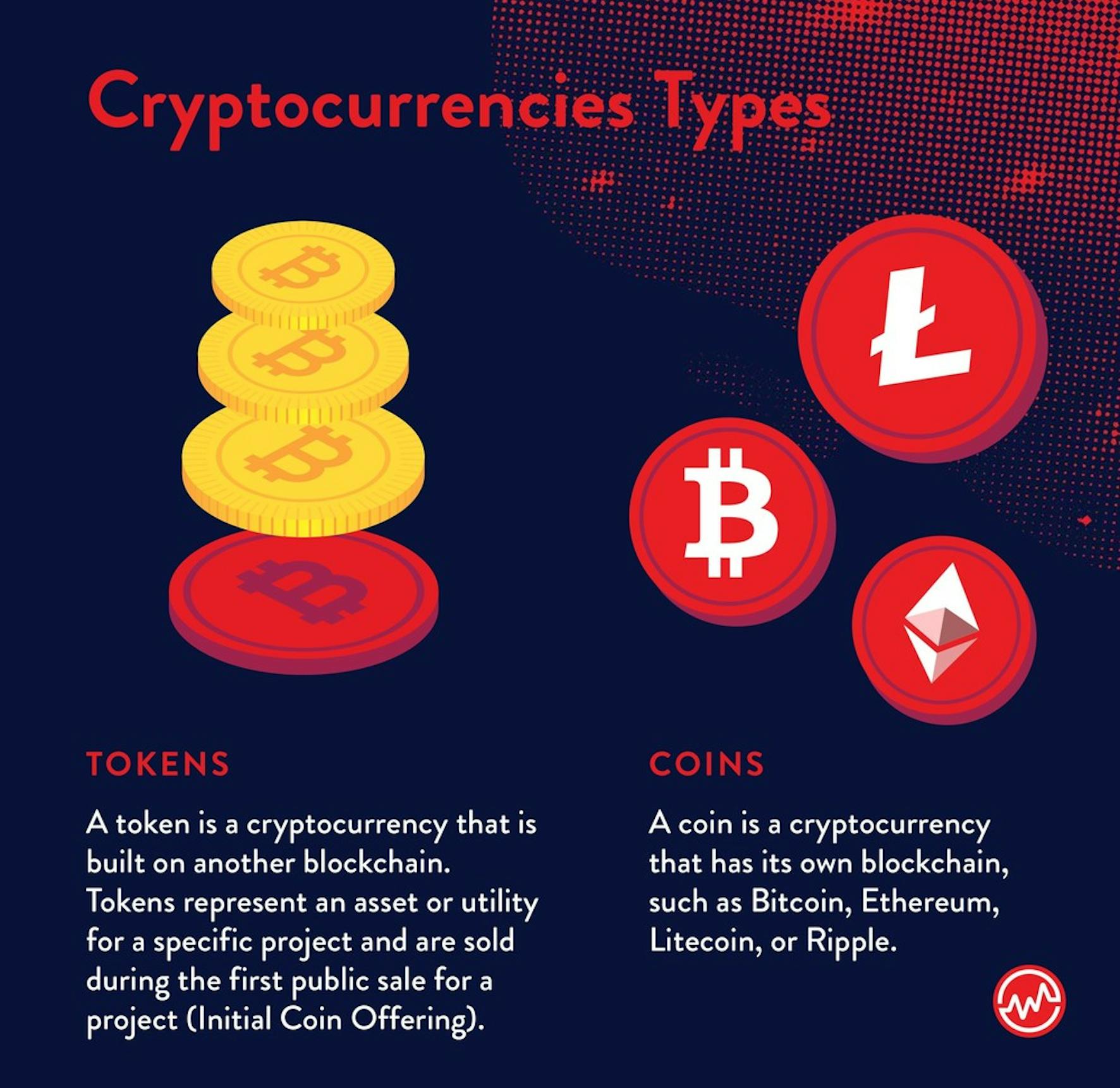

Are all cryptocurrencies the same

In simple words, not all digital currencies are cryptocurrencies, but all cryptocurrencies qualify as digital currencies. It is also important to note that the intricate differences between digital currencies and cryptocurrencies are crucial for regulators, investors, and users. A deep dive into the definition of both terms can help you find the ideal foundation for comparisons between them.

Digital currencies do not have physical attributes and are available only in digital form. Transactions involving digital currencies are made using computers or electronic or digital wallets connected to the internet or designated networks. In contrast, physical currencies, such as banknotes and minted coins, are tangible, meaning they have definite physical attributes and characteristics. Transactions involving such currencies are made possible only when their holders have physical possession of these currencies.

Stablecoins do not have to be tied to fiat currencies. Their value can be determined by just about any other assets ranging from stocks and shares to a basket of government securities. In any case, a stablecoin’s value is directly in line with the assets that back it up.

In simple words, not all digital currencies are cryptocurrencies, but all cryptocurrencies qualify as digital currencies. It is also important to note that the intricate differences between digital currencies and cryptocurrencies are crucial for regulators, investors, and users. A deep dive into the definition of both terms can help you find the ideal foundation for comparisons between them.

Digital currencies do not have physical attributes and are available only in digital form. Transactions involving digital currencies are made using computers or electronic or digital wallets connected to the internet or designated networks. In contrast, physical currencies, such as banknotes and minted coins, are tangible, meaning they have definite physical attributes and characteristics. Transactions involving such currencies are made possible only when their holders have physical possession of these currencies.

Stablecoins do not have to be tied to fiat currencies. Their value can be determined by just about any other assets ranging from stocks and shares to a basket of government securities. In any case, a stablecoin’s value is directly in line with the assets that back it up.